minnesota unemployment income tax refund

If you have an expired income tax refund check mail it along with a written request to reissue it to. This is the official website of the Minnesota Unemployment Insurance Program administered by the Department of.

Where S My Refund Minnesota Department Of Revenue

Tax refunds are starting to go out Monday for Minnesotans who collected unemployment insurance or businesses that received federal loans during the height of the.

. Welcome to the Minnesota Unemployment Insurance UI Program. Paul MN 55145-0010 Mail your property tax refund return to. Individualincometaxstatemnus Business Income Tax Phone.

A spokesman for the Minnesota Department of Revenue said. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. This is the official website of the Minnesota Unemployment Insurance Program administered by the Department of.

Minnesota unemployment income tax refund Friday May 13 2022 Edit. Without that law Minnesota businesses were set to suffer a 30 increase in their unemployment taxes triggered when the fund is below a certain threshold. If you received unemployment benefits in Minnesota before 2021 you can also view your previous 1099-G forms.

Individual Income Tax Phone. Minnesota Department of Revenue Mail. Are the IRS economic impact payments included in household.

Mail your income tax return to. FOX 9 - Many Minnesota tax filers will get an automatic refund within weeks because of tax breaks passed overnight by lawmakers state Revenue Department. Up to 10200 of extra unemployment benefits are also tax-free for people making less than 150000 per year.

100 percent is deducted from your weekly benefit payment. The Minnesota Legislature has passed and Governor Walz has signed into law a Trust Fund Replenishment bill. If you received unemployment in 2020 and filed BEFORE Minnesota changed their law of taxing the unemployment income you may be getting a letter informing you that you will.

On April 29 2022 the Minnesota Legislature passed and Governor Walz signed into law a Trust Fund Replenishment bill. Minnesota Department of Revenue Mail Station 0010 600 N. Minnesota Law 268044 Subd1 Each quarter employers that have employees in covered employment are required to submit a wage detail report electronically.

651-296-3781 or 1-800-652-9094 Email. Welcome to the Minnesota Unemployment Insurance UI Program. Income tax refund checks are valid for two years.

The new law reduces the amount of unemployment. In the year of repayment you may take a miscellaneous itemized deduction for ordinary income items such as unemployment on line 24 of your Schedule M1SA Minnesota Itemized. The new law reduces the amount of unemployment tax and assessments a.

Paul MN 55145-0020 Mail your tax questions to. MDOR expects to communicate these findings later. For taxable year 2020 Minnesota tax law now allows the same unemployment income exclusion as federal tax law.

If you retire from your base period employer your monthly pension payments will. View step-by-step instructions for accessing your 1099-G by phone. Pension or 401K payments.

If you received unemployment benefits in 2020 a tax refund may be on its way to you.

Did The Minnesota Department Of Revenue Suddenly Send You Money Here S Why Kare11 Com

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

Is Unemployment Taxed H R Block

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Taxes Rochester Area Economic Development Inc Small Business Development

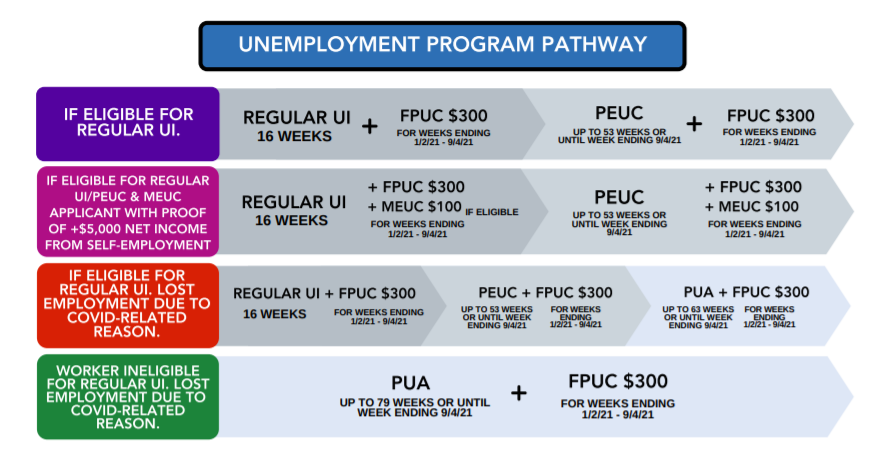

Minnesota Mi Deed Unemployment Benefit Extensions To 300 Fpuc Pua And Peuc Programs Has Ended Retroactive Payment Updates Aving To Invest

Notice Of Intent To Offset Overview What It Means What To Do

Many Minnesotans Will See Automatic Tax Refunds Soon After Legislative Deal

Minnesota Department Of Revenue Set To Begin Processing Unemployment Insurance And Paycheck Protection Program Refunds Christianson Pllp

Because Of One Word Minnesota Can T Issue Refunds For Overpaid Unemployment Tax Minnesota Reformer

Mn Revises 2022 Unemployment Insurance Tax Rates Paylocity

Mn Department Of Revenue Will Begin Sending Tax Refunds For Ppp Loans And Extra Jobless Aid In Next Few Weeks Cbs Minnesota

Minnesota Passes Tax Bill Including Ppp Conformity Olsen Thielen Cpas Advisors

Covid 19 Faqs Anfinson Thompson Co

Tax Preparation Minnesota Valley Action Council

File 2022 Minnesota State Taxes Together With Your Irs Return

Unemployment 10 200 Tax Break Some States Require Amended Returns

Minnesota Tax Law Update Ppp Eidl Unemployment Minnesota Cpa Firm

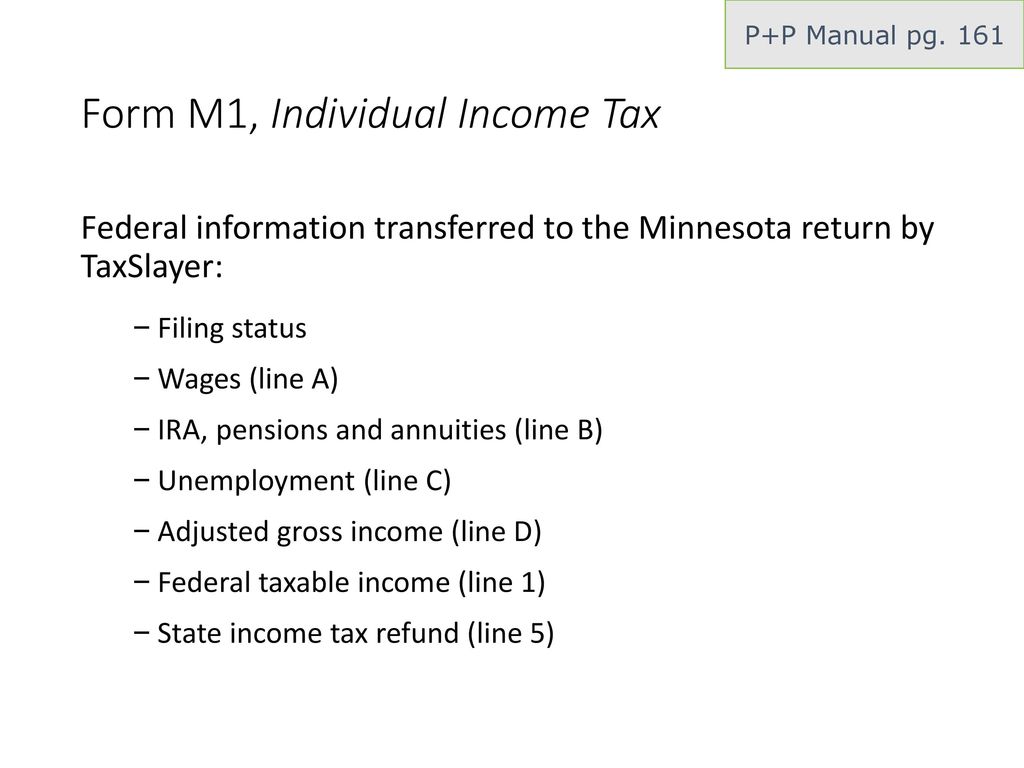

Basic C Minnesota Income And Property Tax Returns Tax Year Ppt Download